Was Your Invoice Rejected Over a Few Cents? Discover How Etendo Solves Rounding and Accounting Imbalance Issues

If you’ve ever had an invoice rejected due to a minor difference in totals, or your accounting showed an unexplained imbalance, you know how frustrating it can be. These small differences — even just a few cents — are common when synchronizing invoices across systems or submitting them to tax authorities, where rounding methods vary, or when accumulated rounding differences appear in your accounting adjustment accounts.

With the Invoice Tax Adjustment functionality in Etendo, included in the Financial Extensions Bundle and available since Etendo 23, companies can adjust their tax amounts down to the cent, keep their accounting balanced, and ensure total precision in reports and integrations — regardless of the currency used.

The problem: invisible rounding and imbalance issues that create major headaches

In day-to-day operations, invoicing and accounting systems don’t always calculate taxes in the same way. Even a tiny rounding variation between platforms can cause:

- Automatic rejections when sending electronic invoices.

- Integration errors due to mismatched totals.

- Customer invoice totals that differ from those generated in Etendo due to different rounding methods.

- Accounting entries out of balance by a few cents.

- Time wasted on manual corrections and reconciliations.

Most traditional ERPs don’t offer a controlled way to fix these issues without modifying the entire invoice or altering accounting records. Etendo changes that.

The Etendo solution: Invoice Tax Adjustment

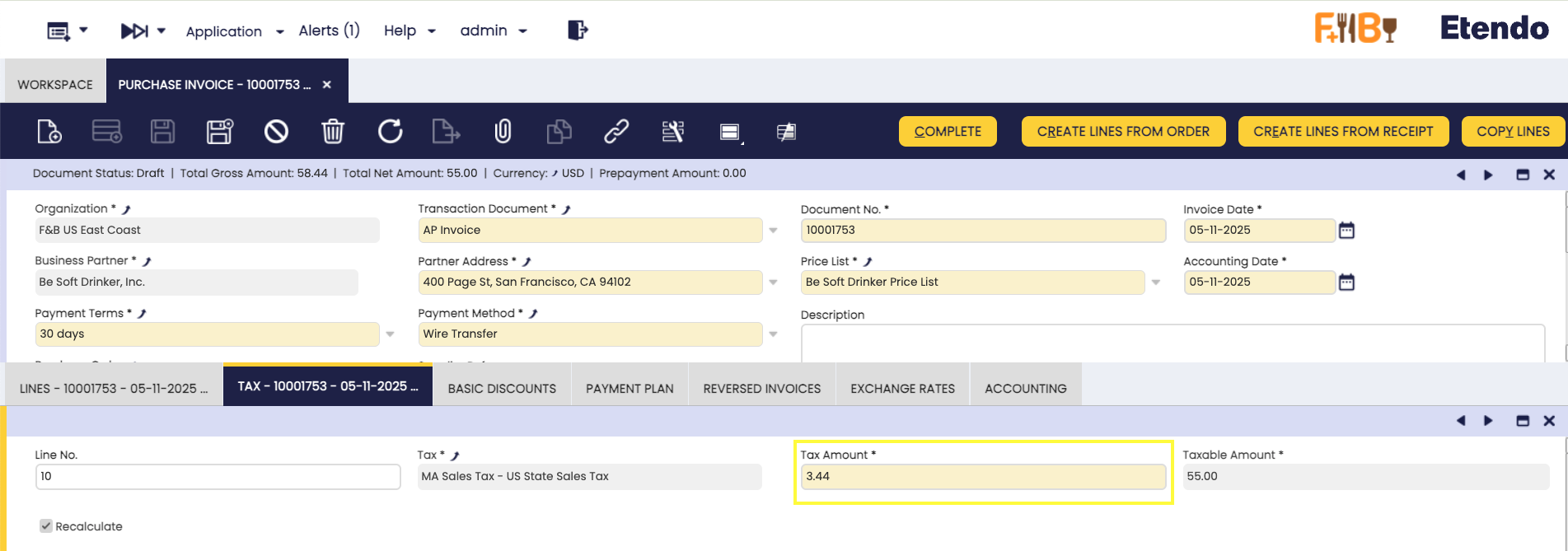

The Adjust Invoice Tax module enables a controlled adjustment on the tax lines of an invoice — whether sales or purchase — directly from the “Tax” tab.

Each tax line can be modified within a limited range (± 0.01 in the invoice currency) to ensure the final total matches exactly with the external system or the values required by tax entities.

Key features

- Available only when the invoice is in Draft status, ensuring traceability.

- Applies to tax lines where both the base amount and tax amount are greater than zero.

- Every modification is recorded for auditing and internal control.

This ensures that invoices in Etendo align perfectly — both in their totals and their accounting impact — maintaining full data integrity.

Benefits for your company

Compliance and precision down to the cent

Etendo ensures each invoice matches exactly, preventing rejections from integrations or fiscal reports caused by rounding differences.

Full traceability and secure auditing

Every change is logged, providing transparency and simplifying both internal and external audits.

Operational efficiency without manual intervention

No more recalculating taxes or editing invoices outside the ERP. Everything happens seamlessly within Etendo’s standard workflow.

Seamless integrations

Adjustments ensure values sent to external systems match exactly, eliminating rejections caused by discrepancies.

Part of the Etendo Financial Bundle

Integrated into the Financial Extensions Bundle since Etendo 23, with no additional development or licenses required.

Practical example

A company issuing invoices notices small differences between Etendo and its fiscal validation system. Thanks to the Invoice Tax Adjustment feature, it can:

- Open the customer or supplier invoice in Draft status.

- Adjust the amounts in the Tax tab within the allowed range.

- Save the changes — adjustments are automatically logged.

- Post the final invoice with no errors or imbalances.

The result: clean integrations, balanced accounting, and zero rejections due to rounding differences — no matter the currency.

How to activate it

- Install the Financial Extensions Bundle in your Etendo 23 or later environment.

- Perform adjustments in invoices that are in Draft status from the Tax tab.

- Save, process, and post: Etendo will automatically record the accounting entries.

👉 View the official module documentation

Summary

The Etendo Invoice Tax Adjustment feature solves one of the most common invoicing challenges:

- Rejections caused by rounding differences.

- Accounting imbalances due to minor tax variations.

- Inconsistent rounding behavior between systems.

With this functionality, companies achieve total accuracy, fiscal compliance, and perfectly balanced ledgers, all within Etendo’s standard workflow.

It’s another example of how Etendo transforms financial management with tools that combine control, efficiency, and global flexibility.

If you would like to learn more, you can contact a sales representative.

FAQ

Can I adjust more than ± 0.01 per tax line?

No. Etendo limits the adjustment to ± 0.01 in the invoice currency to ensure accounting consistency.

Can I do this on posted invoices?

Only for invoices in Draft status.

Which Etendo versions support this?

From Etendo 23 onwards.

Can it be used with any currency?

Yes, the module supports multiple currencies, depending on your Etendo environment configuration.

Does it require additional licenses?

No. It’s included in the Financial Extensions Bundle.

You May Also Like

Asset Amortization Management in Etendo: The Secret to Automating and Segmenting Financial Reports

Asset amortization management in Etendo is the solution that accountants and financial managers have

Bulk Data Upload in Etendo with Google Sheets: Automate and Optimize with AI

Now it’s possible thanks to the new integration between Etendo Copilot and Google Sheets. This fun

Still Creating Invoices Manually? Discover How Etendo 25.3 Automates Document Type Selection per Customer

https://youtu.be/fT0W0XfEw-Y Etendo 25.3: The Update That Eliminates Repetitive Tasks At Etendo, we

Leave a Reply